PORT TO PORCH MARKET FORECASTS

May 23, 2023

Port to Porch Market Forecasts

“As shippers navigate the deflationary market, this is the time to strengthen relationships with loyal carriers. As the carrier supply further exits, the spot market is going to tighten towards the year-end and into 2024, and the tender rejections will likely increase. Building a long-term transportation and procurement strategy is going to help navigate through the inflationary leg of the cycle.”

– Amit Prasad, Chief Data Science Officer

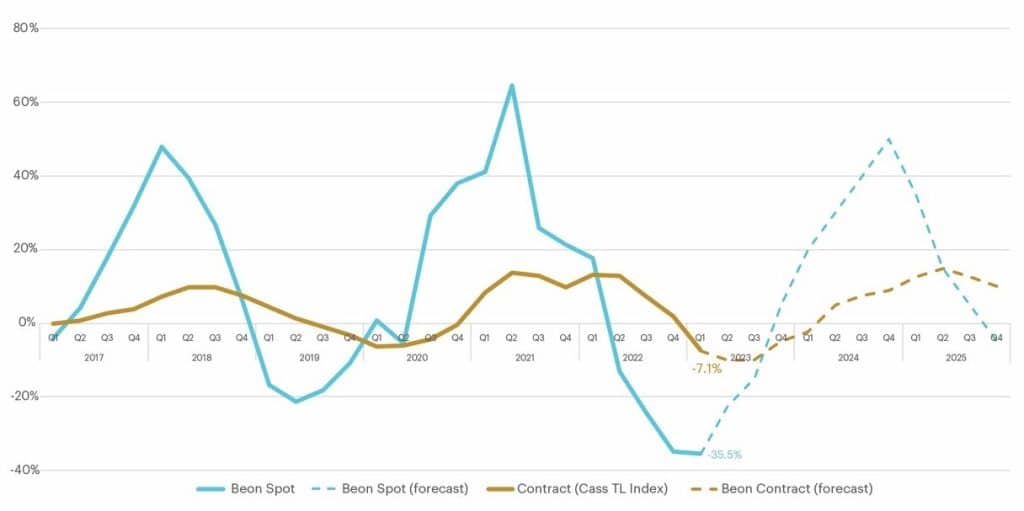

TL Spot & Contract Cost Curve (% YoY Change by Quarter)

Truckload Spot & Contract Forecast with Beon™ Band

- Spot: Lower-than-projected freight demand due to softer economy and plummeted imports in Q1 2023 took the Beon Band* further down to -35.5%, making it the new bottom of the deflationary leg. We project that the curve will now move upwards towards the equilibrium from here with Q2 2023 around -22.5%. We expect that it will stay inflationary for the entirety of 2024 reaching the peak of inflation in Q4 2024.

- Contract: The truckload (TL) contract cycle finally entered the deflationary leg in Q1 2023 at -7.1% year-over-year (YoY), close to our forecast of -7.5%. We expect the contract cycle to go further deflationary in Q2 and Q3 2023. It will likely start heading towards equilibrium in Q4 2023 and should cross the X-axis in Q2 of 2024. Contract cycle lags spot cycle by 2-3 quarters.

*The Beon™ Band rolls up YoY quarterly averages of data to create trend lines. This band is the outcome of the relationship between freight supply and freight demand, with freight demand being driven by the macroeconomic demand indicators. When we overlay the Beon™ Band with the demand curve in a single chart, we can see demand’s influence on the to-the-truck costs.

Mode Forecast

Drayage

Lackluster imports will continue through this quarter as shippers focus on shipment accuracy and carriers adjust to volume challenges. Shipper KPIs drastically shifted compared to Q2 2022, when the main concern was available capacity and tender acceptance.

As of late, shippers are less focused on capacity and more focused on invoicing speed, accuracy, carrier accessorial scrutiny and visibility. Labor tensions on the West Coast are steering shippers to the East and Gulf Coasts, such as Port of NY/NJ, Port of Savannah and Port of Houston. Total U.S. Port TEUs are down YoY, but we have seen a 6.9% increase in volume from February into March 2023.

LTL

This quarter, shippers need to re-evaluate their carrier usage as carriers’ pricing has allowed rates to hold above standard. Many shippers still think LTL carriers should be dropping prices to gain more volume. The reality is some carriers are making small adjustments to prioritize more attractive freight (standard-size pallets, business-to-business). Shippers need to work closely with key incumbents during rate negotiations and service-level reviews to create win-win results.

Parcel

Rate increases are no longer sustainable. Now is the time to be more open to negotiating and diversifying the carrier base as capacity softens.

Some important things to keep in mind for small parcel. In, 2022, the average rate increase for FedEx and UPS was 6.9% compared to 5.9%. The UPS Teamster contract expires on July 31, 2023, as national negotiations began in April 2023. Shippers are moving volumes away from UPS to mitigate the risk of a potential strike. Startups and regional carriers doubled their collective package volume in 2021 and witnessed an additional 25% growth in 2022, according to the Pitney Bowes Parcel Shipping Index.

Cross-Border

Demand for cross-border services between U.S. and Mexico remains strong for the second quarter of 2023 as U.S. and Canadian volume remains low.

Canada

Capacity outbound from Canada, especially out of major metros, remains very strong and up more than 4% YoY according to Census data. Carriers are looking for consistent opportunities to get them on the U.S. side of the border because of the relatively stronger demand for U.S. imports into Canada.

Mexico

Trade between U.S. and Mexico continues to grow, increasing by 10% in the first two months of 2023 compared to the same period in 2022. Mexico was ranked number 1 among U.S. trade partners during the first two months of 2023, showing demand for cross-border transportation services will continue on both sides of the border.

Recent Posts

Impending Tariffs Add Pressure to Drayage Operations

Stay in the Know: Carrier Trends & Market Updates