Q3 2024 Transportation Outlook

Our Q3 2024 Transportation Outlook provides key insights to help you anticipate and plan for the coming changes in the freight landscape.

Timing the Turn: Understanding Indicators to Anticipate Change

To get straight to the point, key market indicators suggest we’re in the early stages of an inflationary freight market – and it looks like this will continue over the next three quarters.

However, several macroeconomic factors are slowing down the speed of the full transition into the next cycle. There still is a lack of consumer confidence, uncertainty due to the upcoming US election in November, uncertainty on when interest rates may lower and more. Unless a significant catalyst occurs, we anticipate a more prolonged transition period, with the peak of the next inflationary cycle likely occurring mid-2025.

Are you prepared to navigate these evolving market conditions with agility and precision? Our Q3 2024 Transportation Outlook provides key insights to help you anticipate and plan for the coming changes in the freight landscape.

We will cover:

- How macroeconomic indicators like GDP, consumer spending, industrial production and imports are shaping freight demand.

- The state of freight capacity and its impact on the market.

- Current trends and forecasts for Truckload Spot and Contract Rates.

- Expectations for other transportation modes including Drayage, Less-Than-Truckload (LTL) and Parcel.

- Strategies to prepare for the upcoming peak season and beyond.

Key Events and What to Watch

GDP, Consumer Spending, Inflation & Interest Rates

- US gross domestic product (GDP) growth showed resilience in Q2 2024, rising at an annual rate of 2.8%, driven by increases in consumer spending, private inventory investment and nonresidential fixed investment.

- Consumer spending on goods rebounded, with durable goods, motor vehicles and parts, and recreational goods showing significant contributions. Real Personal Consumption Expenditure (PCE) increased by 0.6% in Q2 from Q1.

- The Federal Reserve has maintained interest rates at a 23-year high, awaiting more consistent evidence of cooling inflation before considering rate cuts. Experts believe that the first rate cut will occur in September.

- As of August 5, 2024, there are continued concerns about a potential recession in the US economy, fueled by recent stock market declines and a weaker-than-expected July jobs report. Global stock markets also experienced a downturn due to multiple factors to include volatility with the Yen and increasing tensions in the Middle East.

Consumer Confidence and Purchasing Power

- The Conference Board Consumer Confidence Index rose to 100.3 in July, up from the downwardly revised 97.8 in June.

- Personal income and disposable personal income both increased by 0.2% in June, while the personal savings rate declined slightly to 3.4%.

Carrier and Brokerage Attrition

- Carrier exits continue to outpace new entrants for the seventh consecutive quarter, confirming ongoing capacity reduction.

- Since December 2022, 11.4% of freight brokerages have revoked their operating authority, with 4% of those revocations occurring in the last four months alone.

US Presidential Election: Uncertainty and Caution

- The upcoming presidential election is injecting uncertainty into the market, potentially affecting consumer and business spending decisions.

- Historical data suggests potential disruptions in freight volumes and supply chain configurations during election periods.

Imports and International Longshoremen’s Association (ILA) & United States Maritime Alliance (USMX) Contract Negotiations

- US maritime tonnage climbed 10.8% year-over-year (YoY) in Q2 and continued to show robust performance in June, with an 11.9% YoY increase.

- Roughly 20% of import share has shifted from East Coast and Gulf ports toward West Coast ports.

- Four of the past six months showed a double-digit percentage YoY increase in container imports, with the first half of the year averaging 13%.

- The ILA & USMX master contract is set to expire on September 30, with negotiations progressing but experiencing setbacks. The ILA’s plan to present final contract demands in early September and increasing strike mobilization efforts could potentially impact six of the ten busiest US ports in October.

Upcoming Holiday Season and Q4 e-Commerce

- With Thanksgiving being the latest date it can be, this presents potential disruption due to one of the shortest peak seasons in over five years. For reference, the last time Thanksgiving was the latest possible date was 2019. As a result, there may be capacity challenges in the time frame from Thanksgiving to Christmas, particularly for final mile shipments. You may also see shippers begin holiday promotions even earlier this year to combat some of those capacity challenges.

- Key note: Even if there isn’t a huge surge in demand, disruption will still occur due to the condensed shipping days and timing.

- Parcel shippers should pay close attention to rising costs in the fourth quarter, particularly around peak season surcharges from carriers like FedEx and UPS, but along with regional carriers like OnTrac. (See the Parcel section below for more detail).

Core Macroeconomic Metrics

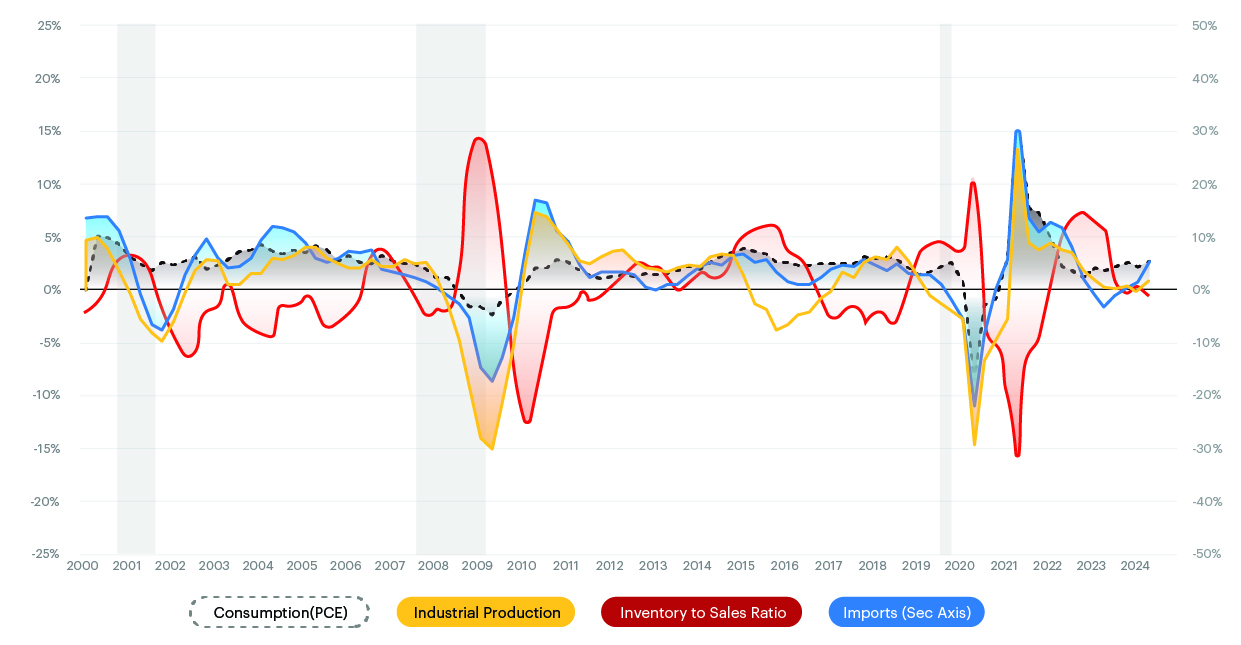

Recent economic data reveals an optimistic scenario marked by resilience and recovery in various sectors. As inflation continued to moderate, Real Personal Consumption Expenditure (PCE) increased by 0.6% in Q2 compared to Q1, driven mainly by service expenditures and a recent uptick in durable goods spending. Industrial production and manufacturing output finally returned to positive growth in Q2 after five quarters of YoY decline.

Additionally, imports saw another strong increase, growing 4.9% YoY in Q2, highlighted by significant gains in maritime container imports. Retail and food services sales also remained strong compared to last year, driven by non-store retailers, while the inventory-to-sales ratio has remained constant at 1.37 for the past four months. These factors combined point toward a dynamic phase of economic recovery with robust consumer activity and revitalized trade and manufacturing sectors.

Source: Bureau of Economic Analysis (BEA), Federal Reserve, Census Bureau, Bureau of Labor Statistics

Personal Income & Real PCE

- Q2 saw the lowest YoY growth in real disposable income in the past six quarters.

- Despite the slow growth in disposable personal income, PCE increased by 0.6% in Q2 compared to the prior quarter, primarily driven by increases in services and durable goods expenditures.

- On a YoY basis, PCE was reported at +2.5%, with durable goods at 2.4%, non-durable goods at 1.7%, and services at 2.8%. Growth in spending on durable goods was led by furniture and household equipment at 3.6% YoY, the highest in the past two and a half years.

- The increase in spending despite lower income indicated that less cash went into personal savings, which dropped to its lowest value since the COVID-19 pandemic began.

Industrial Production (IP) & Manufacturing Output

- IP turned positive, growing 0.4% YoY after three quarters of negative growth.

- Manufacturing Output also turned positive, growing 0.1% YoY in Q2 after five quarters of negative growth.

- The beverage sector reported positive YoY growth due to seasonal demand, boosting truckload volume and driving freight rates up in May and June.

Imports

- Imports of goods and services in the US, which turned positive in Q1 2024, gained further momentum in Q2 and climbed to +4.9% YoY.

- Imports of goods increased by 5.3% YoY, while services improved by 2.8% YoY.

- Maritime Container Imports remained strong in Q2, reporting 11% growth on a YoY basis.

- On average, import volume is 20% higher compared to pre-pandemic levels.

- All major ports showed strong double-digit YoY increases in import volume.

Inventory to Sales Ratio

- The Inventory to Sales Ratio has remained constant at 1.37 for the past three quarters, including Q2 (with data from April and May).

- On a YoY basis, the ratio is reported at -1.1% and -0.4% in April and May respectively. A decline or negative growth in the ratio indicates depleting inventory and a need for restocking, which is favorable for freight volume growth.

- Retail and food services sales remained strong at 2.3% compared to last year, with some drag coming from auto and gas sectors.

- Excluding auto and gas, sales rose to a healthy 3.8% YoY, which is higher than the rate of inflation for goods.

- Non-store retailers continue to show strong growth from 7.3% to 8.9% in Q2.

Freight Demand Metrics

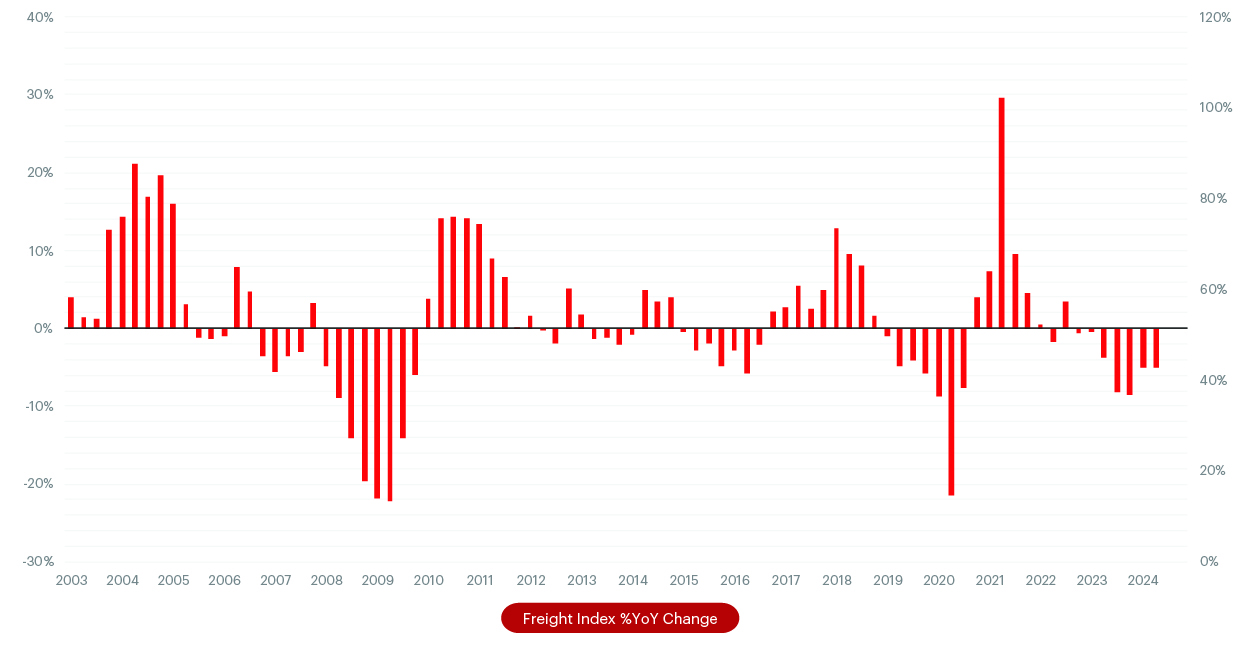

Freight demand for Q2 had some seasonal tailwinds toward the second half of the quarter.

- Cass Freight Index for Q2 was reported 5.1% lower than Q2 2023.

- Truckload tonnage reported by the American Trucking Association (ATA) showed positive growth in Q2 2024 on a seasonally adjusted basis.

Source: Cass Freight Index

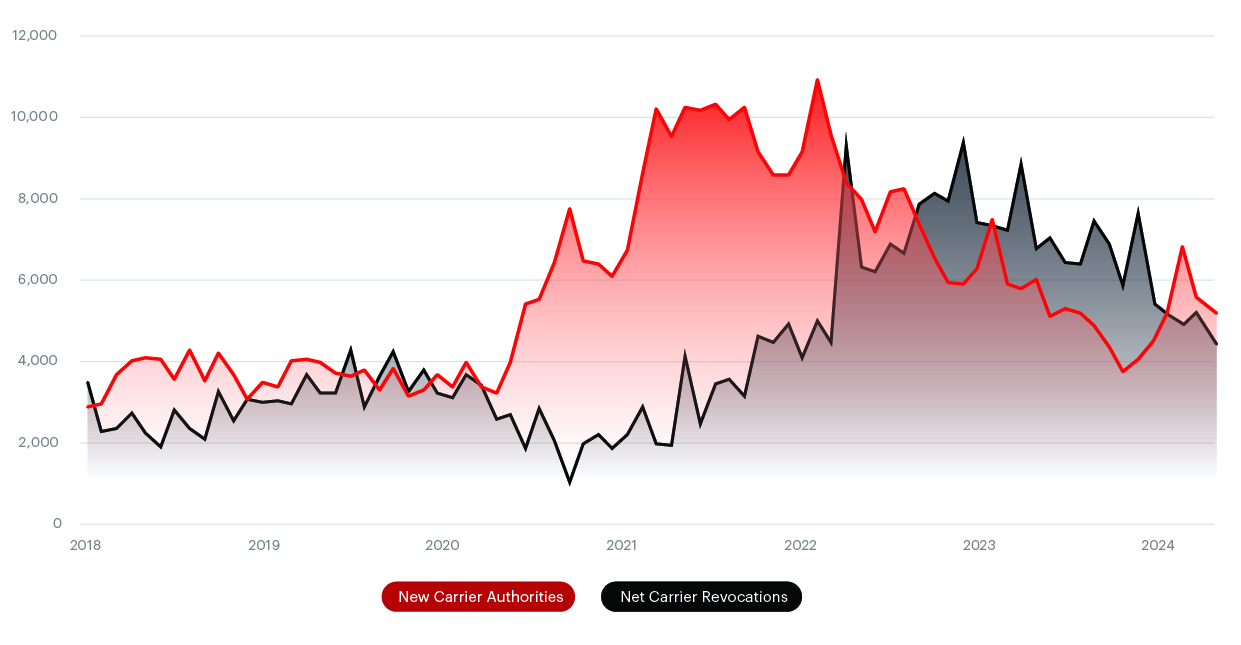

Freight Supply Metrics

For seven consecutive quarters, capacity reduction continues in this oversupplied capacity market. The second quarter of 2024 saw another net reduction of 2,821 carriers after a reduction of 4,241 in the first. Trucking employment for for-hire carriers continued to stay negative at -1.7% on a YoY basis in Q1, indicating that excess capacity remained in the market longer than expected.

Source: Federal Motor Carrier Safety Administration (FMCSA)

More Info:

- Carrier revocations or exits continue to outpace new grants of authority for the seventh consecutive quarter, confirming the continued exit of capacity in an oversupplied market.

- Retail Sales for Class 8 truck orders went negative (on a YoY basis) in Q4 2023 for the first time since Q1 2022 and further dropped to 12.1% in Q2 2024.

- Declining truck order lead time is a strong indicator of capacity exiting the market faster than capacity is willing to enter.

We called the bottom of the market, and we’re on the upswing. The question now is not if, but when we’ll feel the full force of the market shift. While macroeconomic indicators point in a positive direction – with rising tender rejects, increasing imports, and a gradual rise in cost per mile – we’re still waiting for a stronger push to get over this wall. The ‘wall’ of uncertainties, including the upcoming election, inflation concerns, interest rates, global market uncertainty and debt levels, is holding back the full shift from happening right now. We’re in a unique position where we can see the change coming, but the velocity of this change is still to be determined. As we navigate this transitional period, strategic preparation and flexibility will be key for both shippers and carriers.

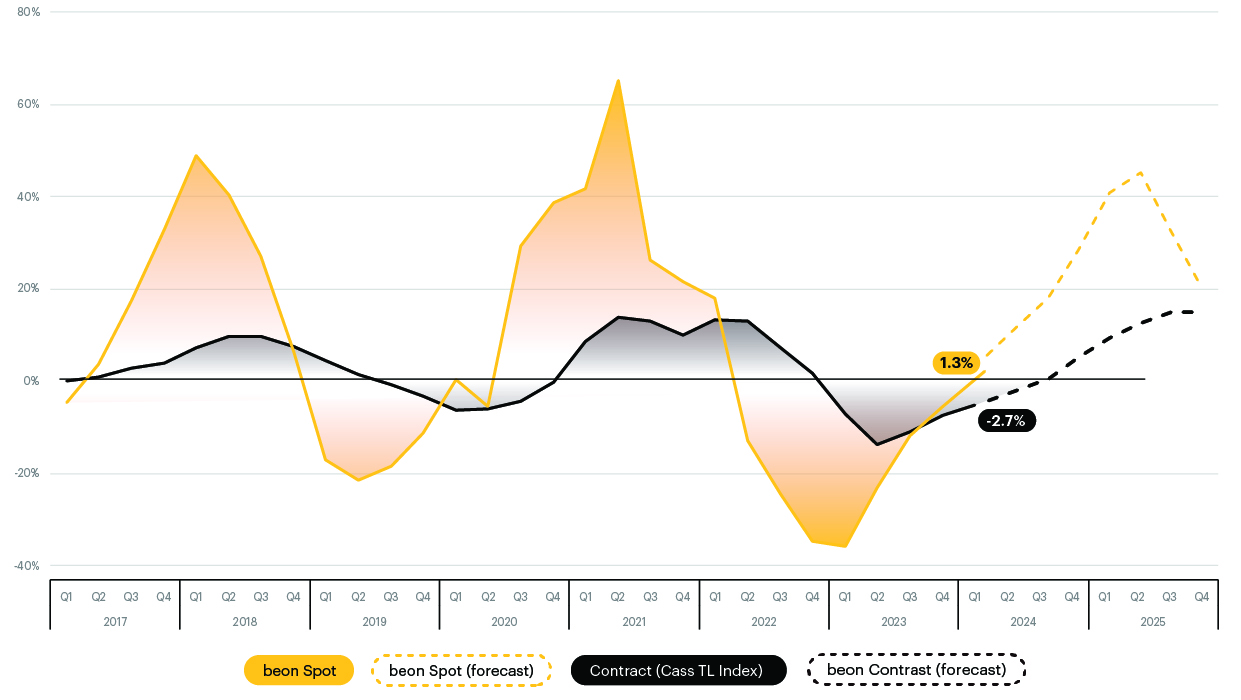

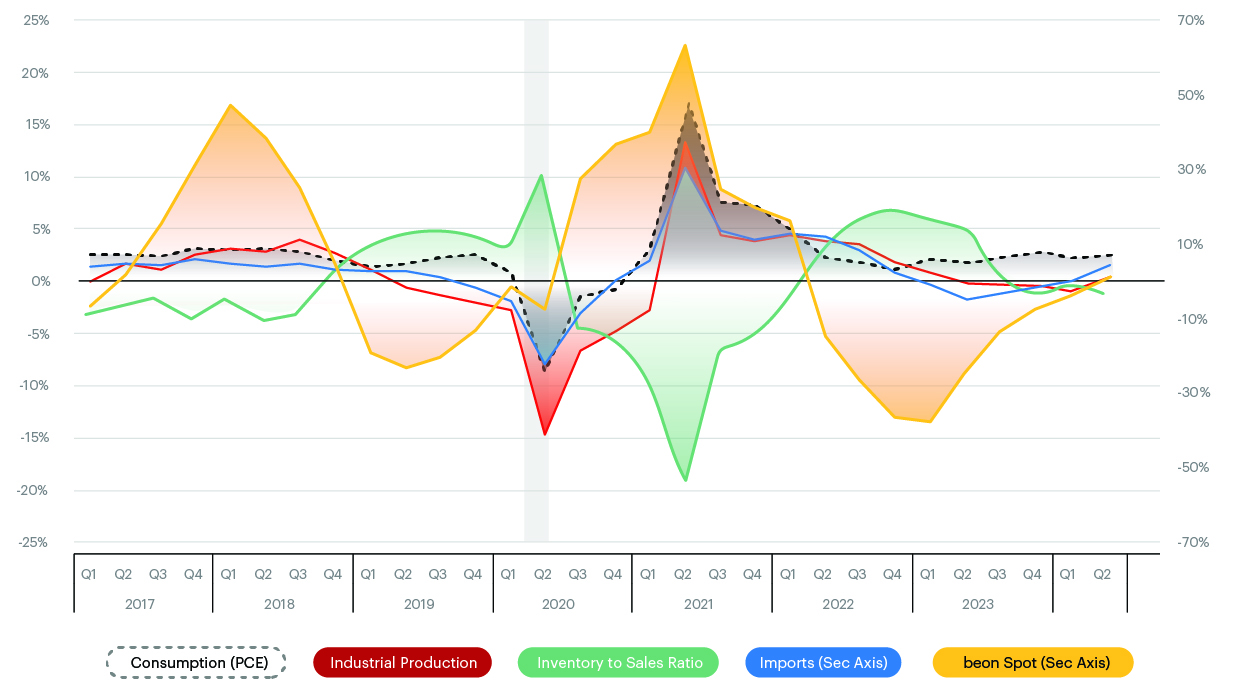

TL Spot & Contract Curve (% YoY Change by Quarter)

What is the Beon™ Band?

The Beon™ Band rolls up YoY quarterly averages of spot and contract freight data to create projections for future freight cycles. This Band is the outcome of the relationship between freight supply and freight demand, with freight demand being driven by the macroeconomic demand indicators. When we overlay the Beon™ Band with the demand curve in a single chart, we can see demand’s influence on the to-the-truck costs.

Source: Beon Band – Transportation Insight & Nolan Transportation Group

When the Beon™ Band is overlayed with the macroeconomic indicators of freight demand, we can understand how some of these factors impact freight rates and thereby forecast where we see the market going over the next couple of quarters.

Rate Forecast

Spot Freight

Coming out of Q1, spot rates fell further in April due to continued softened demand. However, they saw a steady increase in May and June, bolstered by seasonal demand across the Southeast and Southwest markets amid shrinking capacity. This helped push the Beon Band into inflationary territory for the first time after eight consecutive quarters of YoY deflation. The Beon™ Band for Q2 ended at +1.4%, compared to our forecast of +2.5%. We expect the Beon Band to continue moving upward, with Q3 projected to end in the range of 5% to 7.5%. The curve is likely to reach its peak in Q2 2025.

Contract

As expected, contract rates have gradually increased since bottoming out in Q2 2023. The second quarter of 2024 reported a -2.7% YoY change, very close to our forecast of -2.5%. We expect contract rates to climb further toward equilibrium with Q3 ranging between -1% to +1% YoY, thereby turning inflationary in the second half of the year. It’s important to note that the contract curve typically lags behind the spot curve by approximately two quarters.

Port to Porch Market Forecast

Drayage

- The ILA & USMX master contract expires on September 30. The negotiations are ongoing; however, setbacks have occurred as of late July. The ILA will present its final demands in early September. This has the potential to impact six of the 10 busiest US ports in October if a strike were to occur.

- Expectations are for a more “regular” peak season compared to last year. Volume increases have already begun, with some shippers frontloading to mitigate peak season concerns, and the National Retail Federation (NRF) anticipates strong performance.

- US West Coast ports are likely to maintain the majority of volume due to East Coast strike threats, the ongoing Red Sea crisis and Panama Canal water level issues.

Less-Than-Truckload (LTL)

- American Trucking Association (ATA) reported LTL tonnages 8.3% lower YoY and volume 7.1% down YoY implying a soft demand market.

- Despite the drop in LTL tonnages, revenue per shipment was 2.7% higher YoY for LTL shipments, indicating more pricing discipline and power exerted by LTL carriers.

- Carriers are focusing on selective freight acceptance, targeting the “right freight at the right price.”

- Ongoing mergers and acquisitions, e.g., Knight-Swift acquiring DHE to begin the build-out of a national LTL network. They are still determining Northeastern coverage.

- 2025 National Motor Freight Classification (NMFC) changes will continue in 2025. On January 30, 2025, the National Motor Freight Traffic Association (NMFTA) will have its initial review followed by the public meeting on March 3, 2025. Freight class changes will go into effect on May 3, 2025.

Small Parcel

- UPS, FedEx and OnTrac continue to demonstrate aggressive pricing strategies. Within the last eight months, the carriers have changed the fuel tables three times (12/2023, 4/2024, 7/2024) totaling 1.75 points for UPS with FedEx being .25 less expensive.

- UPS announced it will become the primary air carrier for the United States Postal Service (USPS) beginning in October 2024.

- The US parcel market saw its first revenue decline in seven years despite increased parcel volume.

- UPS announced Peak Season Surcharge which will impact 100% of all residential deliveries.

- Note: FedEx has not released its announcement regarding Peak Season Surcharge.

- UPS modified its shipping charge correction fee qualification by cutting it in half, but doubling the price. Significant impacts to e-commerce and vendor direct shipments.

- OnTrac continued expansion into the Midwest and added service coverage for an additional 17 million people.

- USPS continues to focus on Destination Delivery Unit (DDU) efficiency and technical advancements, while also planning to remove the less-than-a-pound shipping options which will impact postal consolidator options.

- The US is set to intensify scrutiny on de minimis shipments, potentially impacting e-commerce giants like Temu and Shein.

Leadership Talking Points

In this Outlook, we’ve covered key events to monitor, analyzed current macroeconomic demand indicators and freight supply metrics, and provided projections for truckload spot and contract rates along with our port-to-porch forecast.

Here’s how you can address questions your executive team may have about what to anticipate in the coming months.

- Current State of Freight: The transportation market is transitioning from a shipper-favorable environment to a more balanced one. Rates are expected to continue rising through Q3 and Q4.

- Implications for Shippers: As the market balances, shippers should prepare for potential disruptions in routing guides and increased shipping costs. Carriers may abandon contractual obligations in favor of higher spot market rates, requiring a more flexible approach to freight management.

Here are some ways you can plan ahead in the coming quarters relative to transportation strategy.

- Strategic Carrier and Capacity Management: As the market evolves, focus on rewarding carriers that consistently meet commitments while preparing for potential capacity fluctuations. Develop robust routing guides with reliable secondary and backup options, and begin planning early for peak seasons. This approach ensures network stability and service quality, particularly during challenging periods.

- Carrier Mix and Incumbents: When assessing carrier performance and considering changes, look beyond linehaul costs to evaluate the broader impact of operational factors. Establish a “price point threshold” to determine when switching providers makes sense, weighing potential cost savings against the value of incumbent relationships and service reliability.

- Lane Optimization: Create predictable and efficient lanes for your carriers. This benefits both your operations and carrier operations, potentially reducing costs and creating a win-win scenario.

- Comprehensive Cost Evaluation: When assessing carrier performance, consider the broader impact of operational disruptions, such as penalties for late deliveries and additional costs from last-minute spot market use.

- Leveraging Partnerships: Utilize partnerships with transportation and logistics providers to conduct detailed analyses of your transportation needs. These partners can offer valuable insights and support in optimizing your strategies.

- Market Adaptation: Rather than attempting to predict market trends, use the insights and data analytics provided to set realistic expectations with your leadership and finance teams, especially as you approach budget planning for 2025.

As we navigate through the remainder of 2024, it’s critical to stay informed about market trends and be prepared to adjust strategies accordingly. The freight market is poised for significant change, and those who anticipate and plan for these shifts will be best positioned to succeed in the evolving landscape.

On this page:

Subscribe to our Newsletter